Topic Definitions

RACI Matrix

PESTEL Analysis

JTBD

PII

SWOT

PEST

Strategy Synthesis

SWOT Analysis

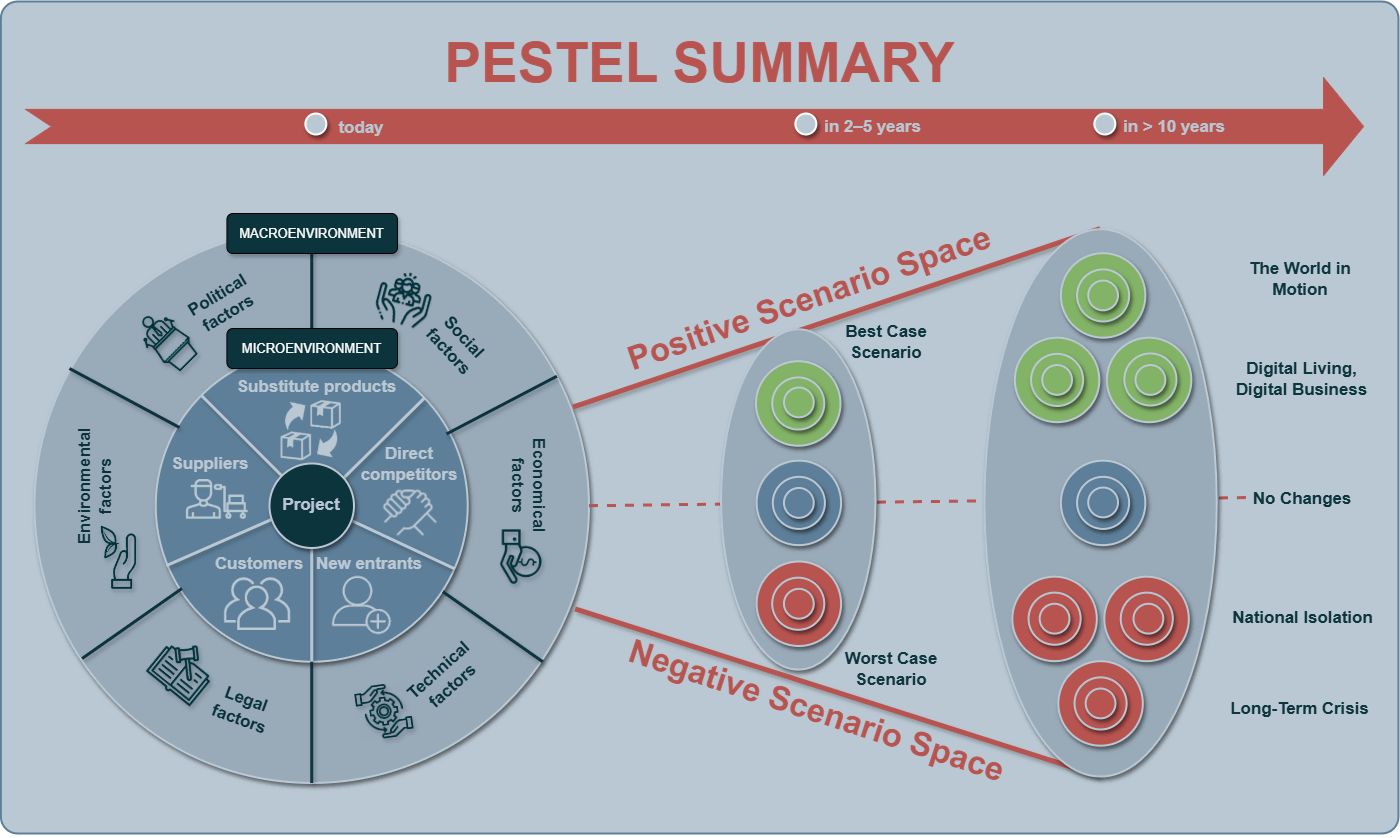

External Environment of the Project #

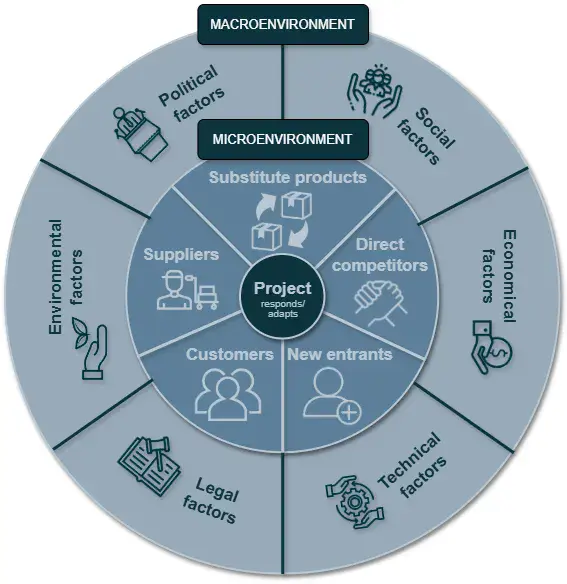

Macro factors → affect industry conditions & constraints → shape microenvironment → affect project.

Start Market Analysis from the Outer Circle:

Any market analysis begins with the macroenvironment — the outer circle of external factors that influence all industry players simultaneously.

This is a fundamental step: it forms the context in which the company, the project, and the competitors will operate.

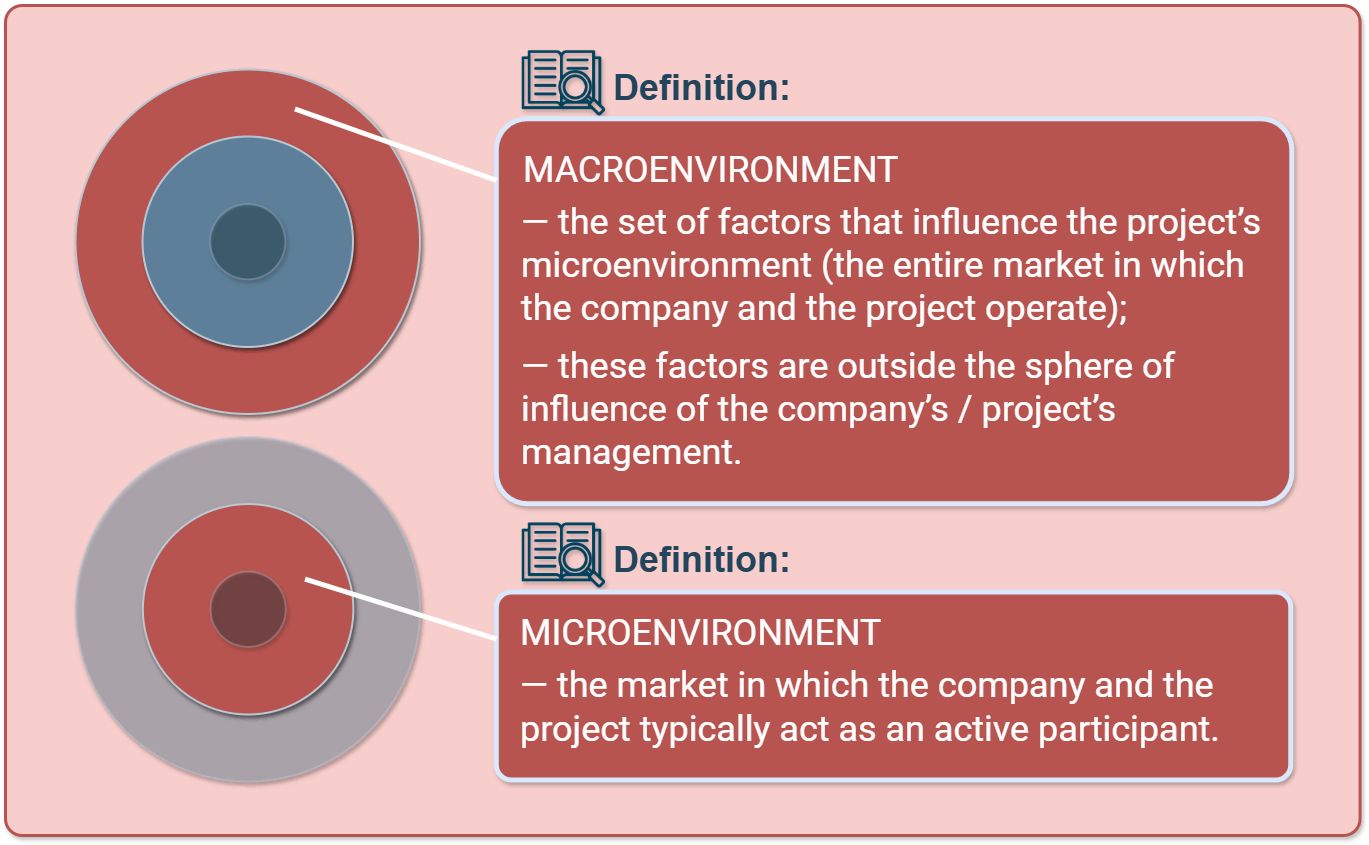

If we imagine the market as a system of concentric circles, then:

the outer circle contains uncontrollable forces (politics, economics, technology, society, ecology, and law);

the inner circle contains the market players (customers, suppliers, competitors, new entrants, substitutes);

at the center is the project, which responds to all these signals.

Macro-factor analysis helps not only to understand the current situation but also to predict likely changes in the environment and prepare for them in advance.

Purpose of the Analysis

No project exists in a vacuum — it develops under the influence of the external environment. To predict how the market will evolve, it is necessary to analyze macro factors step by step, transforming observations into scenarios.

- PESTEL factors (context) → Trend statements (interpreted change) → Drivers (systemic leverage points from Cross-Impact) → Scenarios.

- Factors ≠ Trends ≠ Drivers

Macro-factor Analysis Answers the Following Questions:

- Which trends are shaping the future of the industry?

- Which factors are limiting development?

- Which directions may become new growth opportunities?

- Which scenarios are possible if external conditions change?

Purpose:

- To understand the environment in which the project will operate and which long-term forces may change the rules of the game.

Key Tasks:

- Scanning the macroenvironment (PESTEL)

Study the political, economic, social, technological, environmental, and legal contexts. - Identifying drivers and barriers

Determine the forces that may accelerate or slow down market development. - Scenario modeling

Create possible future development scenarios and assess the project’s sensitivity to environmental changes.

General Logic of the “Pipeline”:

-

PESTEL Analysis

document concrete factors + validate them with data and sources + make an initial assessment of trend/impact/confidence.

-

Scenario Trend Scan

transform factors into defined trends with time horizons and signals, normalize probability and impact using agreed scales.

-

Cross-Impact Assessment

for the top trends, record directional influences on one another (who affects whom and to what extent), calculate driver score and vulnerability score, and identify key drivers and weak points.

-

Sensitivity Mapping

build scenarios from the identified drivers (configurations of trends), calculate probability, impact on the project, and priority (risk/opportunity score) for each scenario, resulting in a ranked scenario list and sensitivity maps.

Tools and Methods of Analysis #

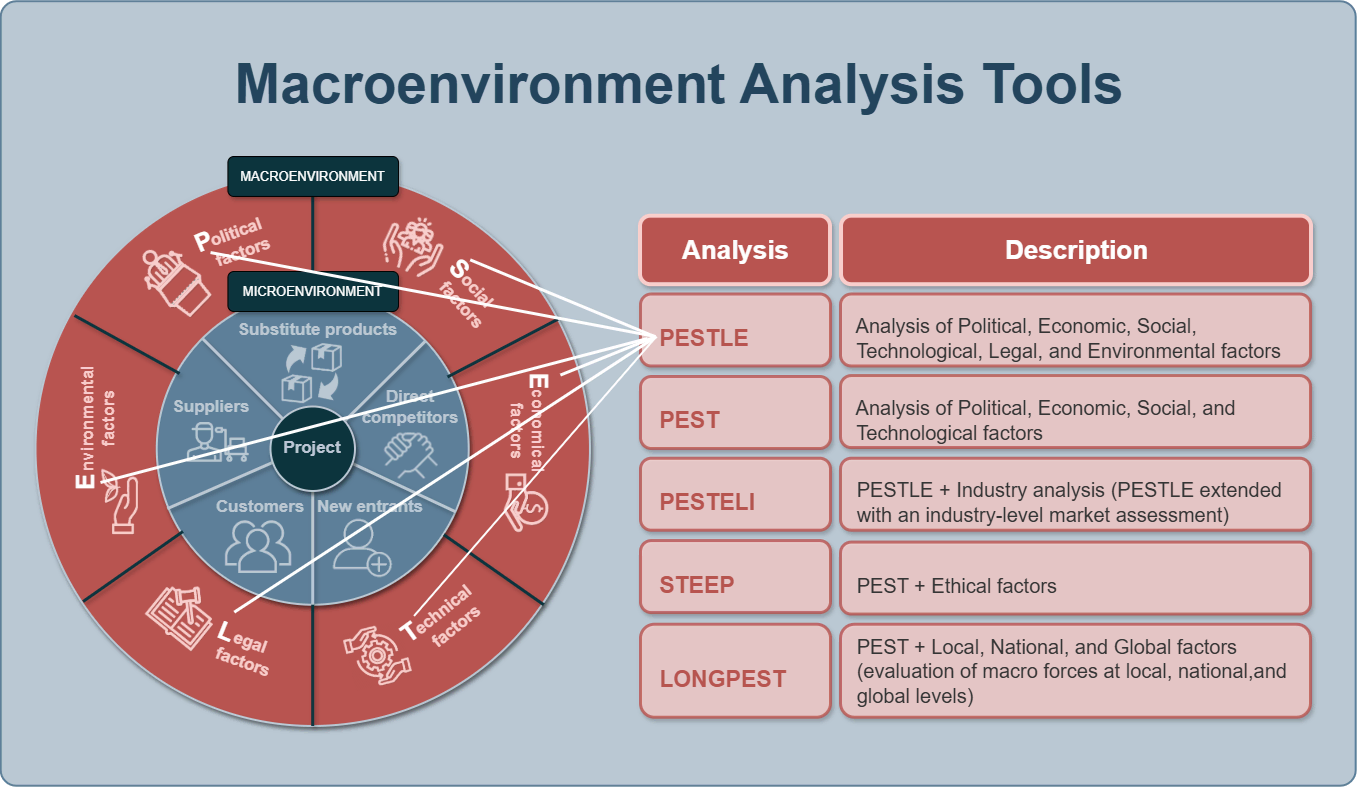

PESTEL Analysis

PESTEL Analysis — the foundational framework for assessing the external environment.

PESTEL is a systematic approach to structuring the factors that influence a project:

-

Political

political and legal decisions, stability, tax policy, government programs.

-

Economic

macroeconomics: inflation, exchange rates, income levels, investment climate.

-

Social

demographics, cultural values, lifestyle, consumer behavior.

-

Technological

innovation, speed of technology adoption, R&D, automation.

-

Environmental

ecology, climate, sustainability, emissions regulation.

-

Legal

laws, licensing, standards, consumer and data protection.

Extended Variants:

- PESTLEI — adds industry analysis (Industry).

- STEEP — includes ethical aspects (Ethical).

- LONGPEST — evaluates factors at the local, national, and global levels.

Purpose:

- Understand which external forces shape the industry and where the main risks and opportunities are located.

Stage Logic:

- Compile a list of potential factors.

- Validate them with facts (data, numbers, sources).

- Assess the strength and direction of influence.

Role:

- To create a “framework of the environment,” which later becomes the foundation for scenarios, SWOT, and competitive analysis.

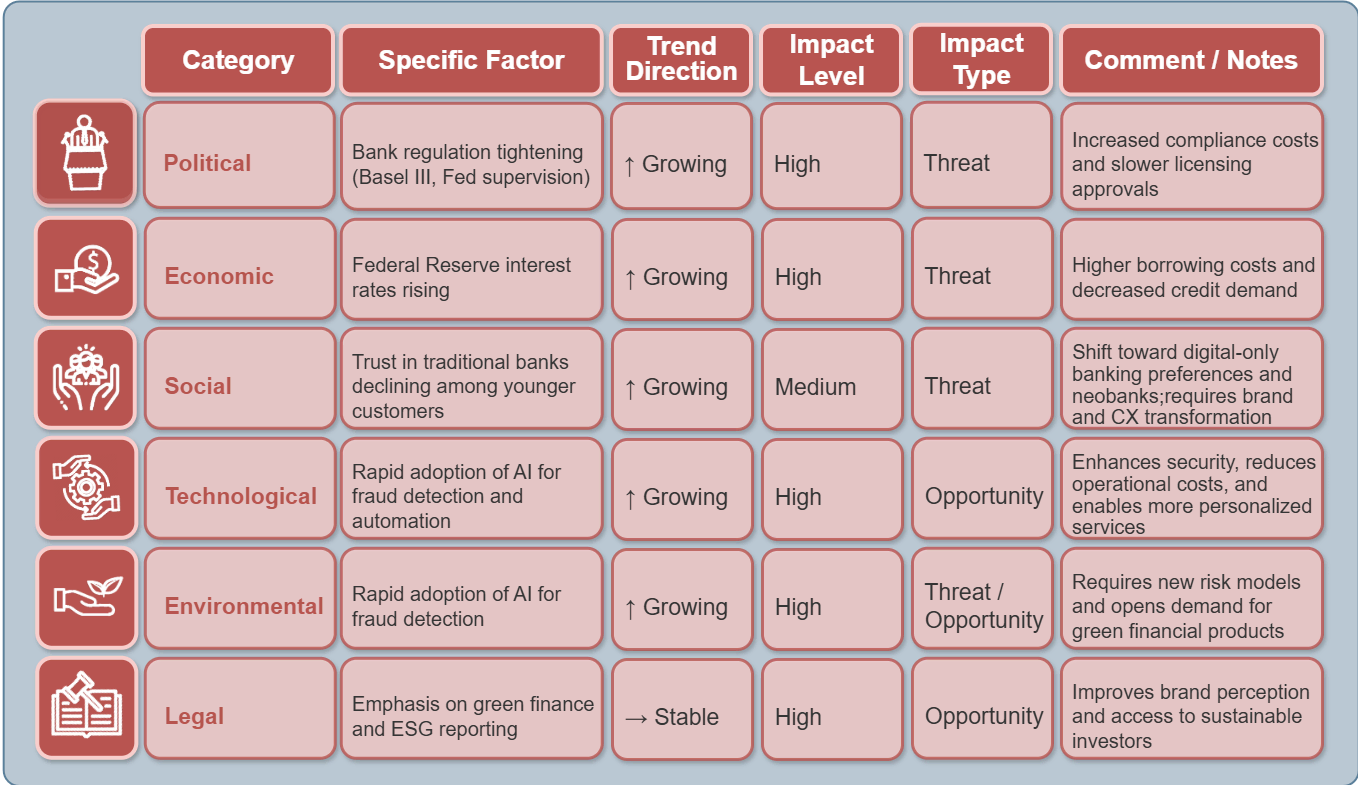

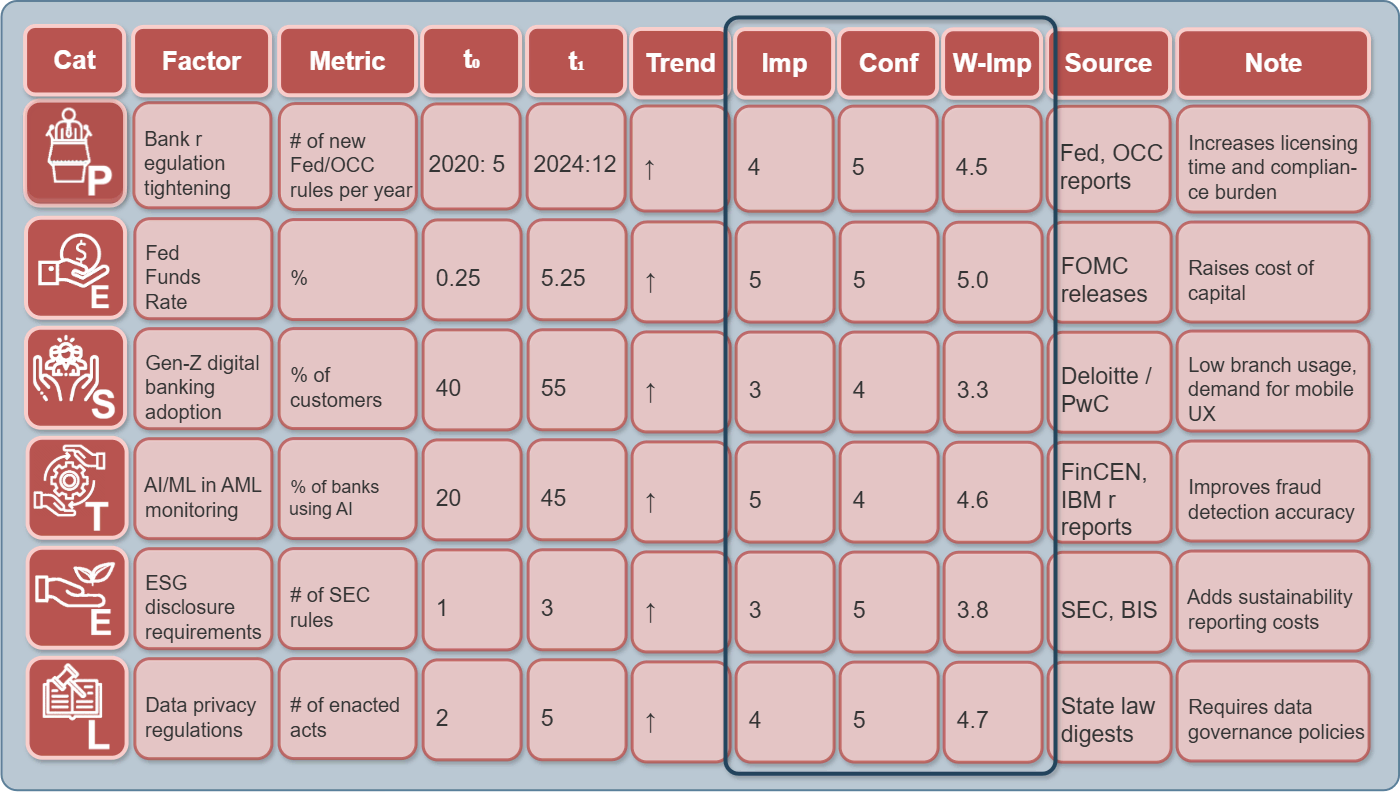

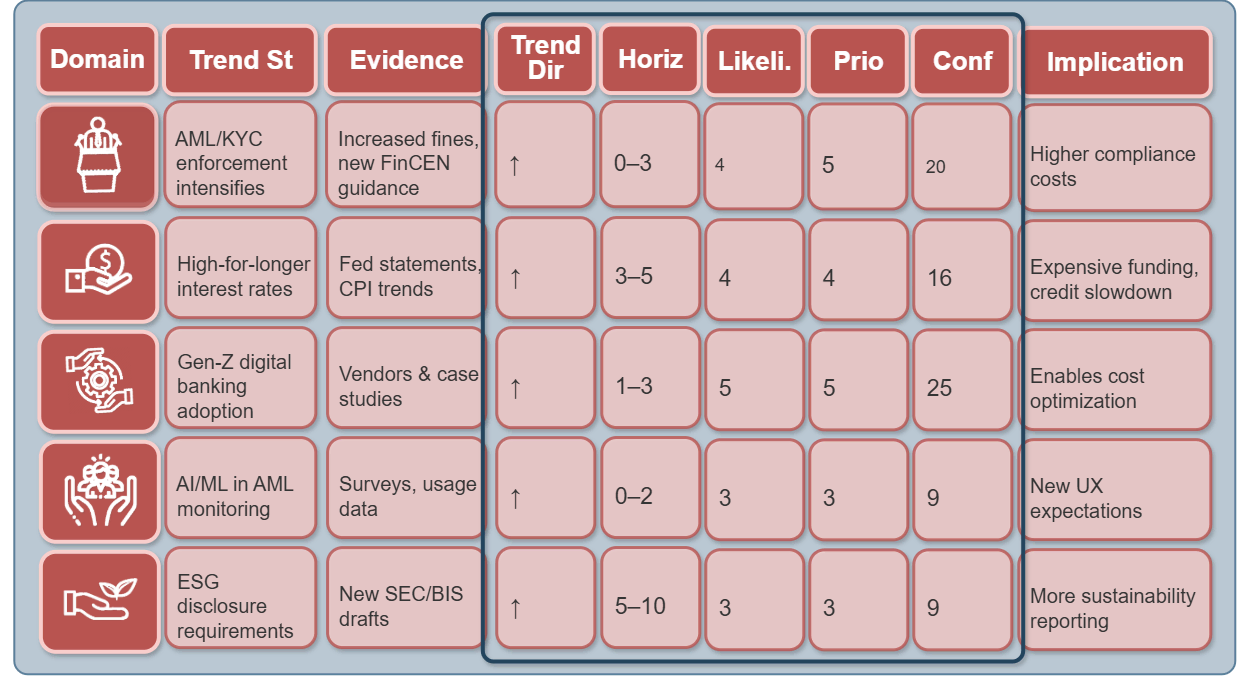

The first visual block — “PESTEL Analytical Table” and “PESTEL Summary Dashboard” — shows which specific factors are relevant for the U.S. banking industry:

-

Political

stricter regulation and Basel III oversight

-

Economic

increase of the Federal Reserve interest rate

-

Social

AI adoption in AML

-

Technological

declining trust in banks among younger audiences

-

Environmental

focus on ESG

-

Legal

tightening of KYC/AML requirements

The table below displays metrics, trend direction, and commentary for each factor.

This is a real table demonstrating how external factors are distributed across the six PESTEL categories. The sample case, “launching a bank in the USA,” reflects actual data on regulation, interest rates, ESG, and AI.

How to Read it:

- Each row represents a separate factor.

- Color coding indicates the strength and direction of the trend.

- Used for initial identification of risks and opportunities.

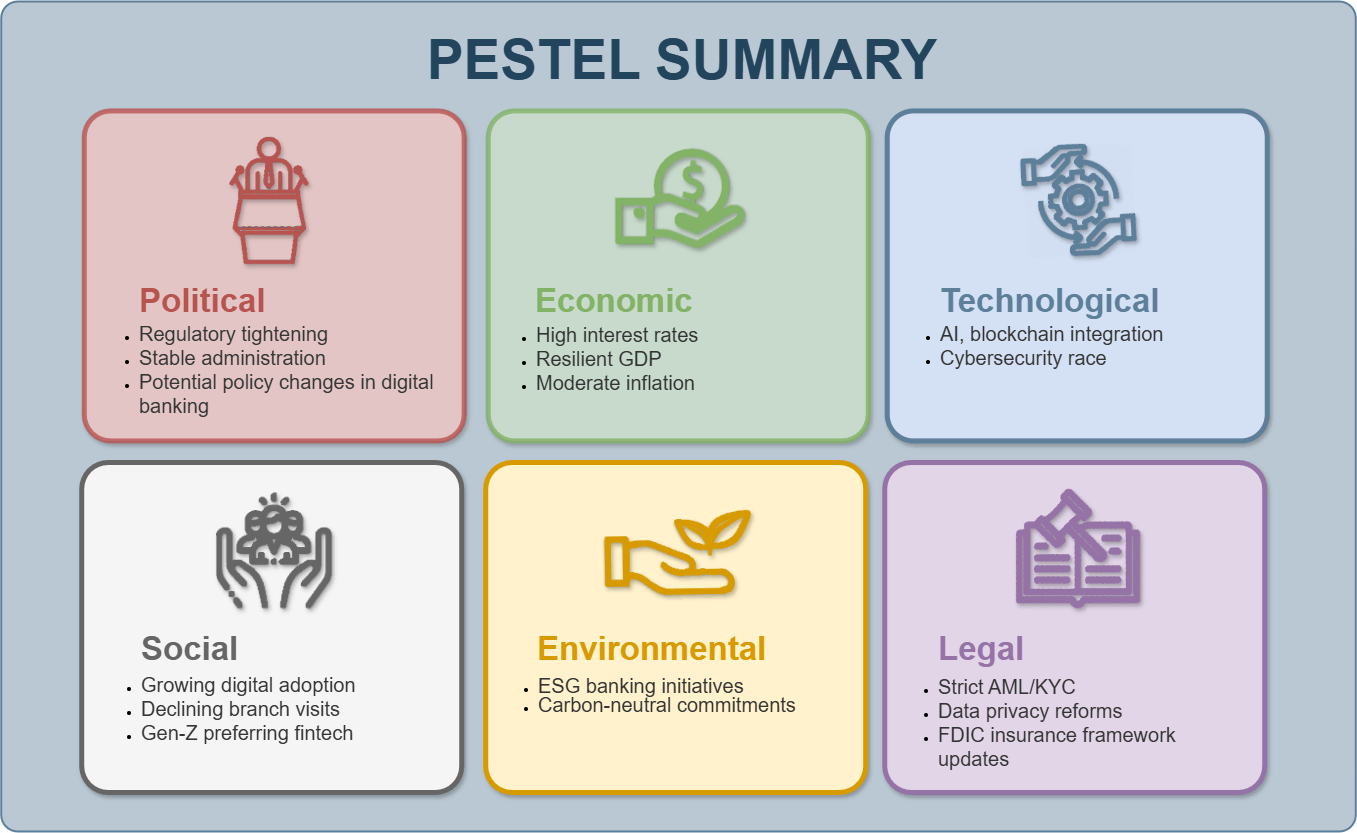

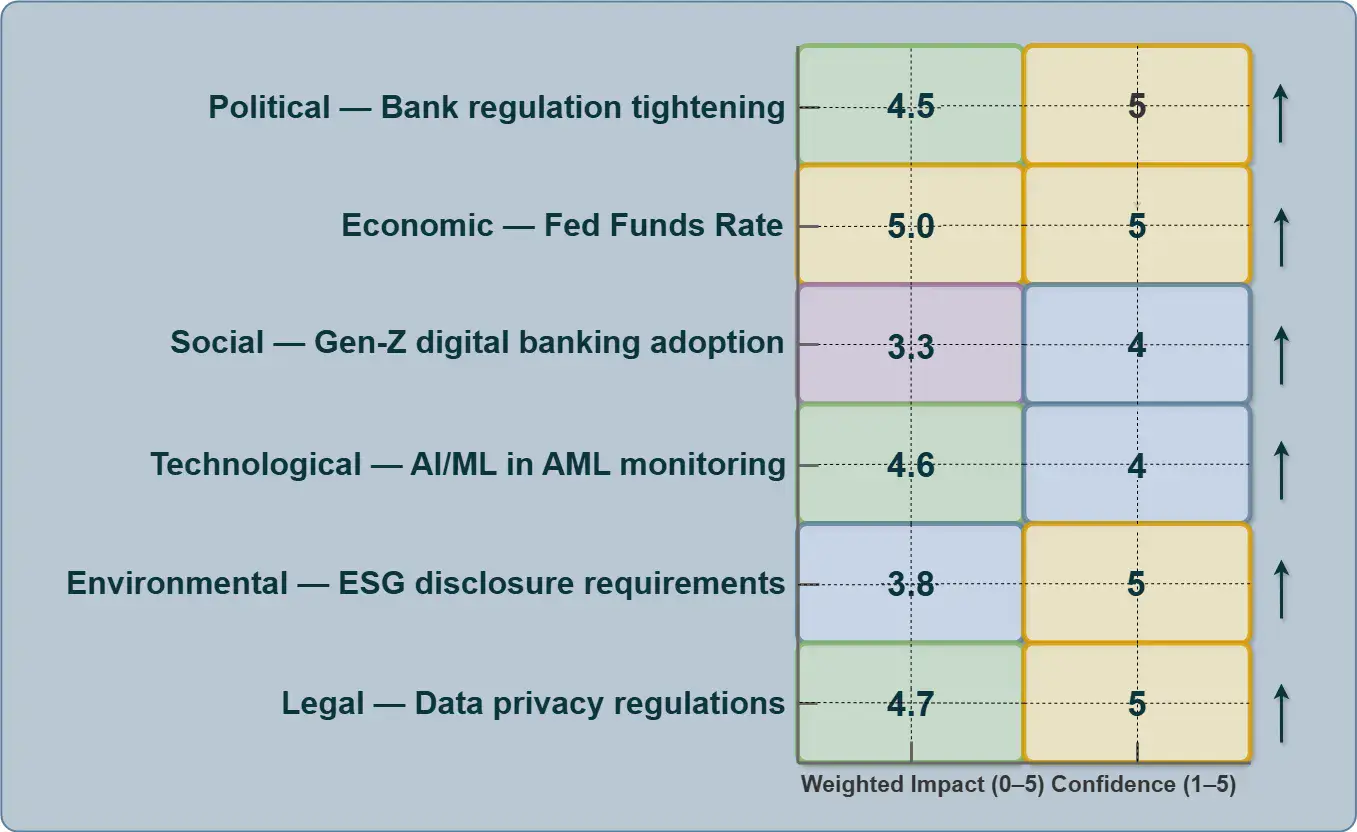

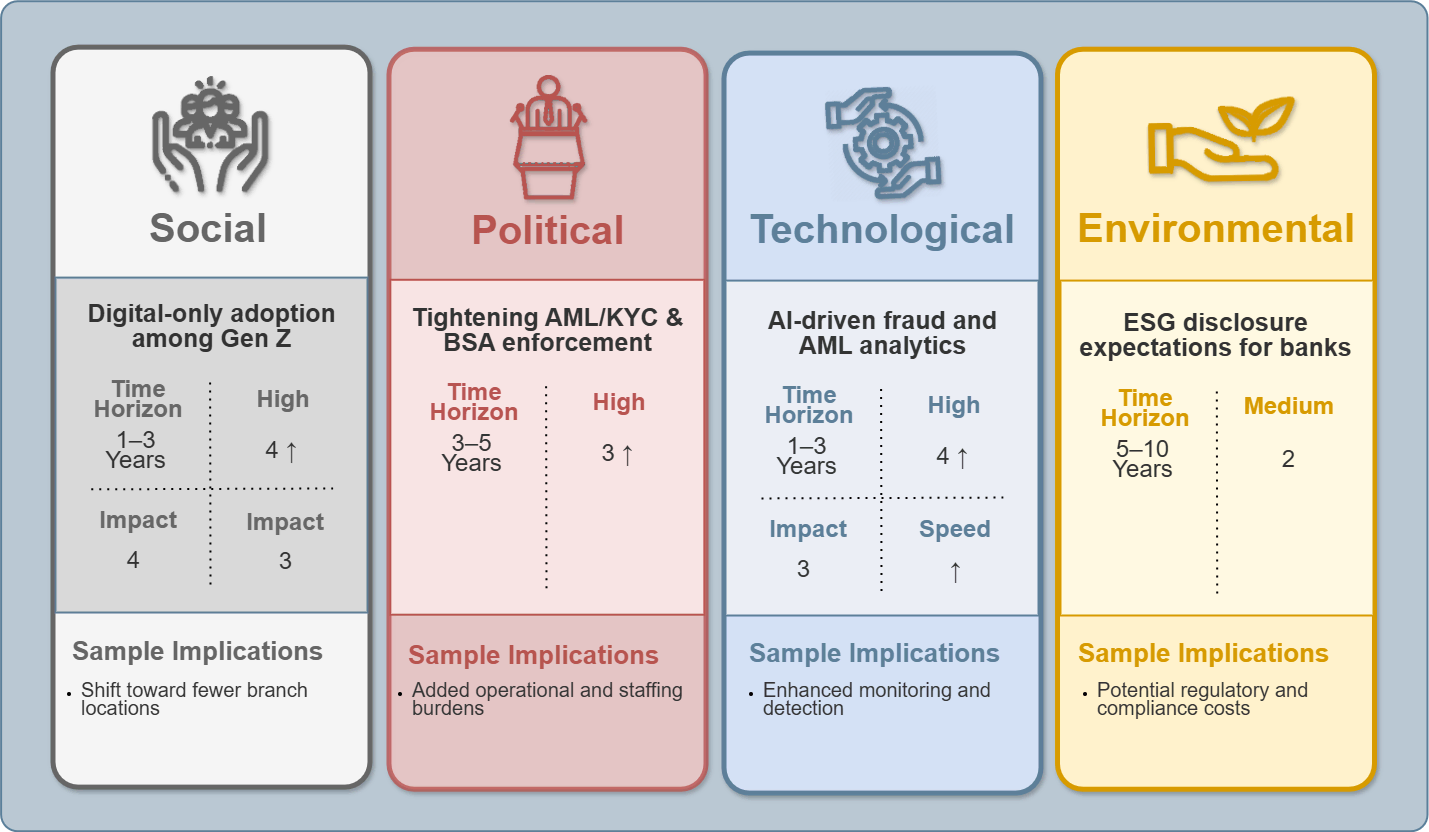

The card-style dashboard below visualizes these categories as “zones of external pressure.”

The dashboard summarizes the results of the PESTEL analysis in the form of cards with key insights.

This allows you to quickly identify where the highest pressure on the industry is located (for example, in the Legal and Technological sectors).

Interpretation:

- The dashboard is used as a “quick environment map” — it shows which forces are strengthening and which are weakening.

Detailed Breakdown of the Method Using the Case “Opening a Bank in the USA”

Step 1. Forming Factor Hypotheses (Draft List)

At this stage, specific phenomena that influence the market are identified.

For the project “Opening a Bank in the USA”, this may include:

-

Political

Basel III Endgame, federal regulatory shifts, government oversight trends.

-

Economic

Federal Reserve rate hikes, inflation, rising unemployment.

-

Social

Customer shift toward digital-only banks, declining trust in traditional institutions.

-

Technological

AI/RegTech for fraud prevention, increasing cybersecurity requirements.

-

Environmental

ESG requirements, “green” lending.

-

Legal

Stricter AML/KYC requirements, OCC licensing procedures, compliance obligations.

Step 2. Validating Factors with Data (Research)

Each factor must be researched and backed by evidence:

For each factor, gather:

-

Metric:

Quantifiable measure (e.g., interest rate %, fraud incidents/year).

-

Baseline (t0)

The initial reference point for the factor.

-

Current Value (t1)

The current value of the factor at the time of analysis.

-

Trend Direction:

↑ Increasing / ↓ Decreasing / → Stable.

-

Data Source:

Official reports (Fed, FinCEN, BIS, IMF, etc.)

-

Comment:

Interpretation for the project.

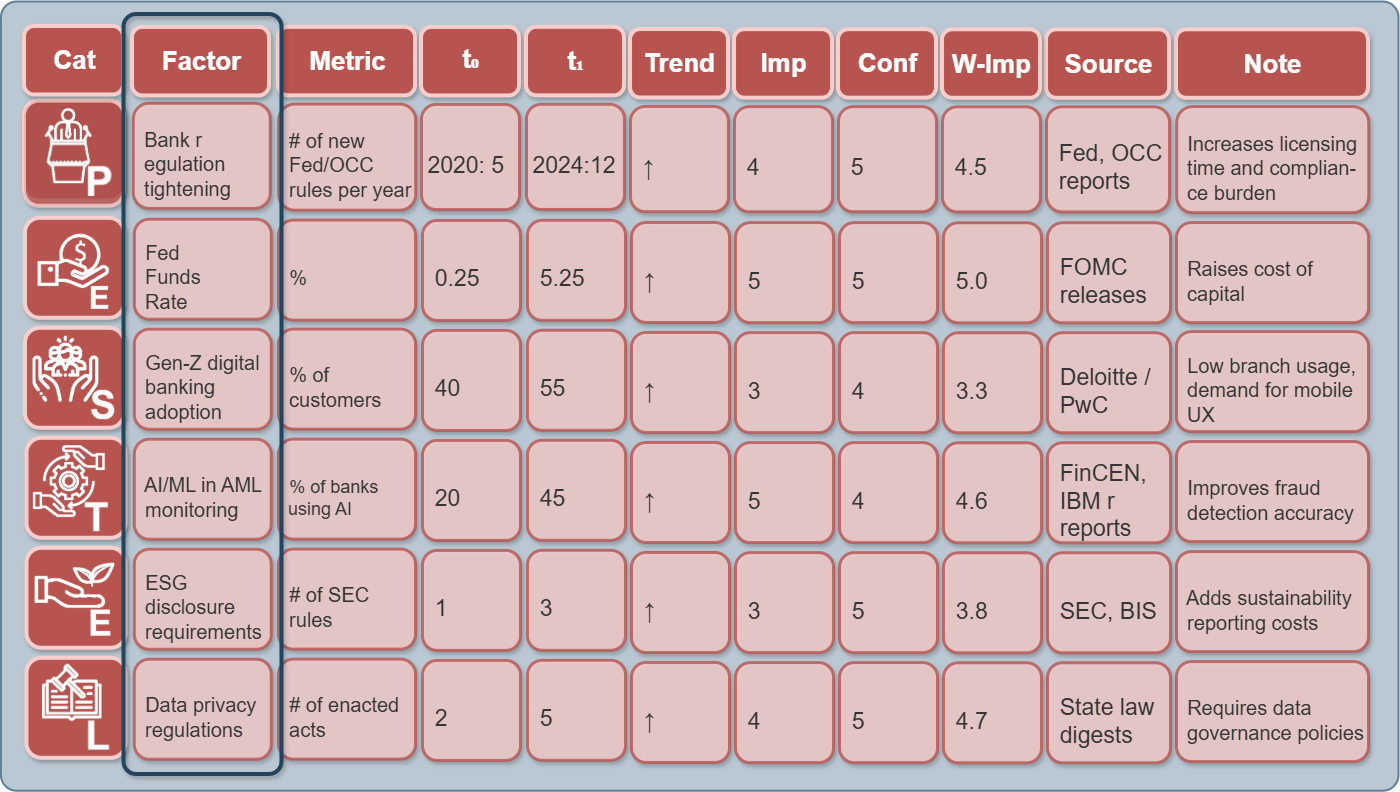

Step 3. Normalizing the Evaluations

Use a numeric scale:

-

Impact:

A numerical score showing how strongly the factor influences the project or market.

-

Confidence:

Data quality (1–5).

-

Confidence-Adjusted Impact:

A confidence-adjusted estimate of impact, reflecting both the strength of the factor and the reliability of the underlying data.

💡 Confidence-Adjusted Impact (CAI)

= Impact × (0.6 + 0.1 × Confidence)

PESTEL Weighted-Impact Heatmap

(Data from Macro Factors Template)

What it Shows:

For each category (Political, Economic, Social, Technological, Environmental, Legal), the chart displays the weighted impact values and confidence scores.

Example for this case:

- Political — Bank regulation tightening (4.5 / 5) → Stricter banking regulation — strong impact.

- Economic — Fed Funds Rate (5.0 / 5) → The Federal Reserve’s high-rate policy — maximum impact.

- Technological — AI/ML in AML monitoring (4.6 / 4) → Rapid adoption of AI for AML monitoring.

Interpretation:

- The dashboard is used as a “quick environment map” — it shows which forces are strengthening and which are weakening.

Outputs:

- A map of the competitive landscape.

- Validated CSFs and SWOT hypotheses.

- Analytical hypotheses for strategic decision-making.

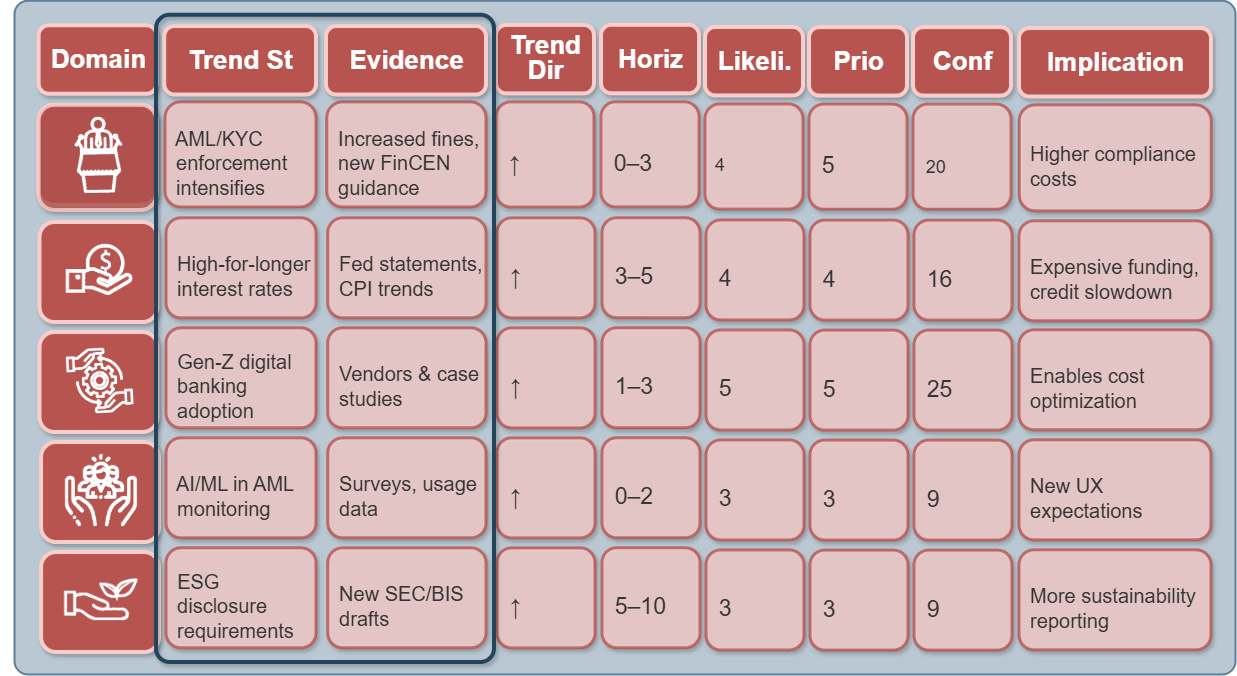

Scenario Trend Scan (STEEP / DESTEP)

A scenario is a possible state of the future driven by key impact factors’ trajectory

This method is used to identify long-term trends and weak signals that have not yet become obvious but may significantly reshape the market.

It applies extended categories (such as Demographic or Ethical) and operates across long time horizons.

Purpose:

- To identify long-term trends and early signals of change in order to forecast how the macro environment is likely to evolve in the future.

Methodology

Step 1. Select Key Factors from PESTEL.

From the list of factors, select those that have high impact and a growing trend.

1. Define the time horizon (5–10 years).

2. Collect data for each dimension (social, technological, economic, etc.).

3. Identify early signals — weak indicators of emerging trends.

4. Build a trend map and assess each trend’s direction (growing, declining, uncertain).

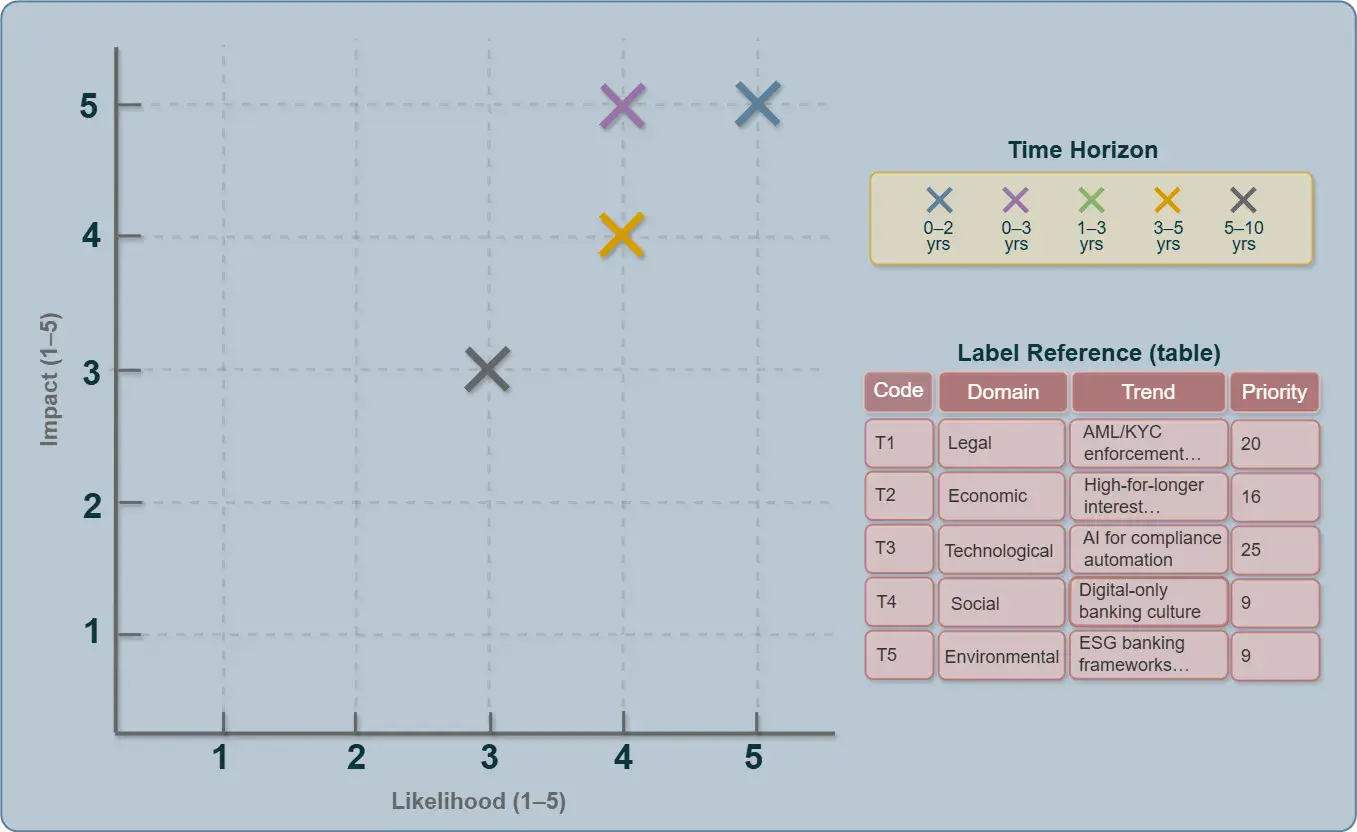

Step 2. For Each Eactor, Document:

-

Trajectory:

↑ growing / ↓ declining / ↔ stable / ± volatile.

-

Time Horizon:

0–2 / 3–5 / 5–10 years.

-

Likelihood (1–5):

probability of continuation.

-

Impact (1–5):

effect on project KPIs.

-

Priority =

Monitoring & sequencing metric.

Result:

- A structured set of hypothetical directions for the development of the external and internal environment, formed on the basis of assessing dynamics, time horizons, likelihood, and the impact of factors, which serves as a foundation for the subsequent construction of alternative project development scenarios.

Visualizations

Trend Cards Grid

Cards with icons and color coding indicating probability and time horizon. Each card provides a concise description of a trend. They show which trends will have an impact in the next 1–3 years and which ones will influence the market in the long term.

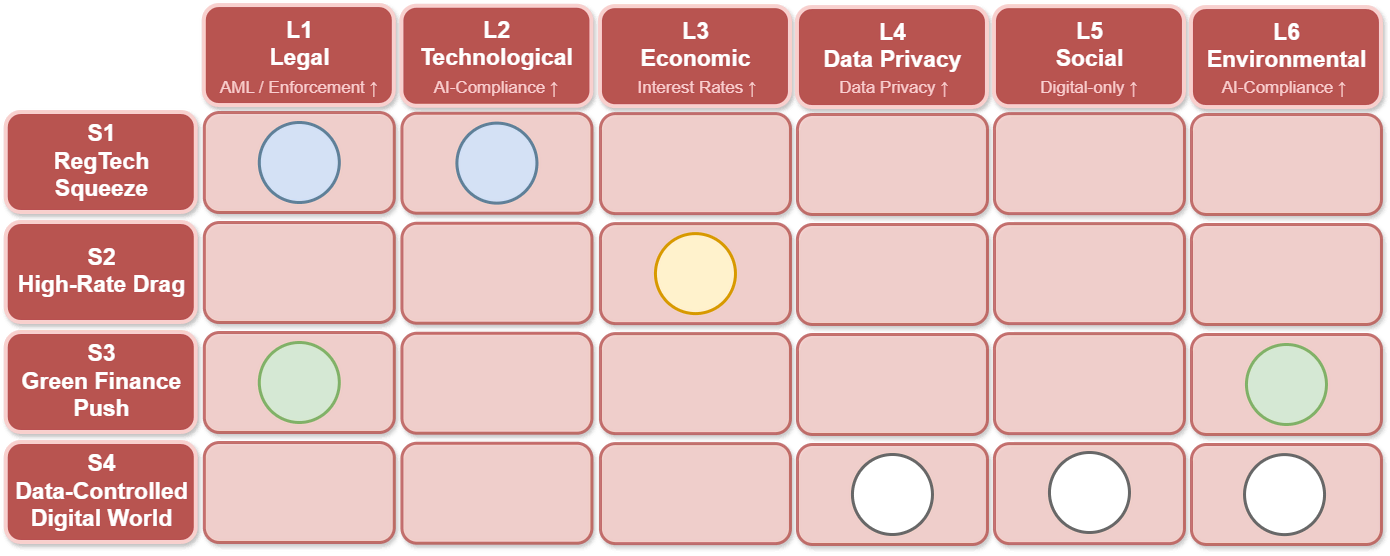

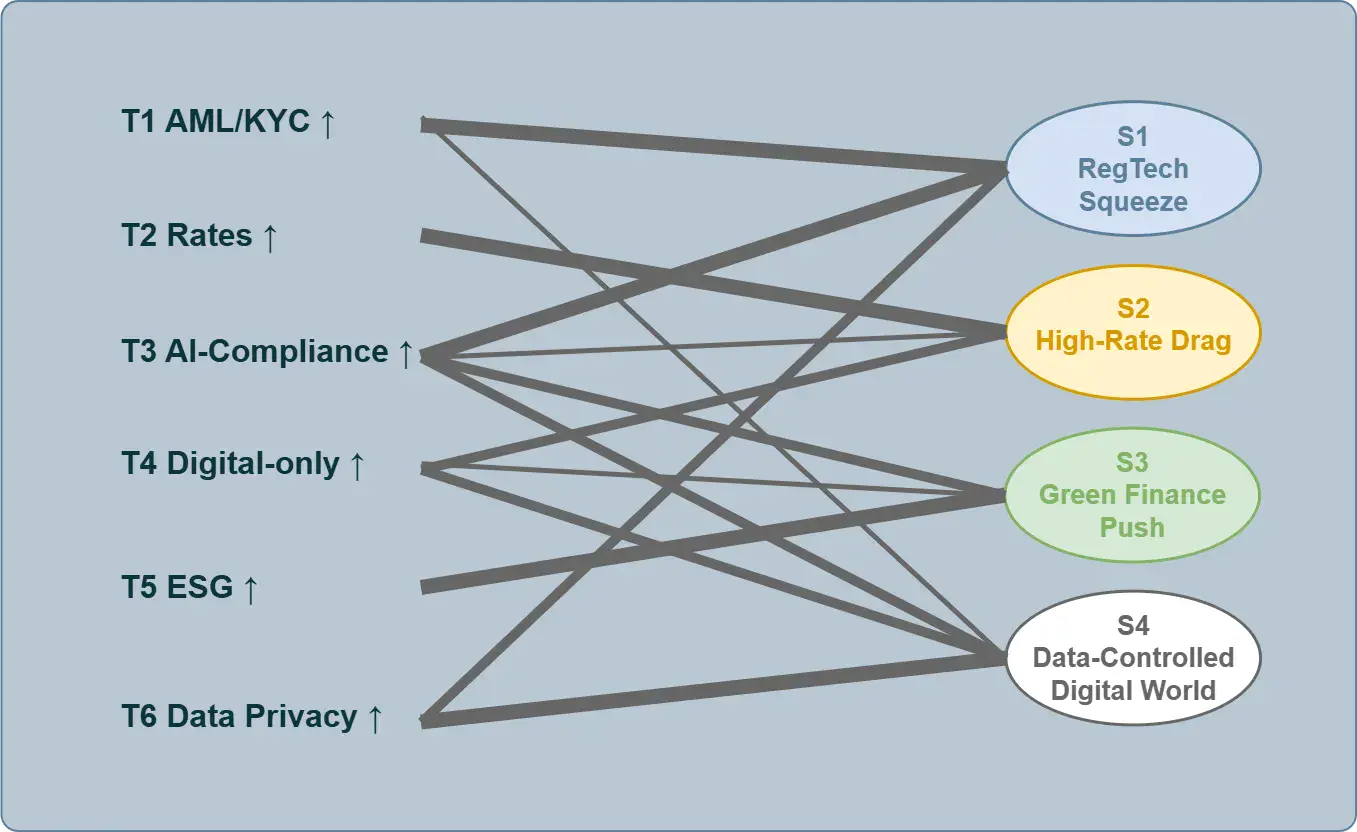

Scenario Trend Matrix (Cross-Analysis of STEEP Trends)

The table presents a cross-analysis of six macro trends (STEEP factors) across four market development scenarios:

- S1 — RegTech Squeeze

- S2 — High-Rate Drag

- S3 — Green Finance Push

- S4 — Data-Controlled Digital World

Rows represent the scenarios, columns represent the key macro-trend domains, circles indicate the degree and nature of each trend’s impact on a scenario.

Trend Domains (Macro Trends):

-

Legal — AML / Enforcement ↑

Intensification of regulatory and enforcement pressure (AML/KYC, BSA).

-

Technological — AI-Compliance ↑

Growing role of AI and automation in compliance and RegTech.

-

Economic — Interest Rates ↑

Prolonged high interest rate environment.

-

Data Privacy — Data Privacy ↑

Stronger data control, privacy regulation, and data governance requirements.

-

Social — Digital-only ↑

Shift of customers toward digital-only banking and changing consumer behavior.

-

Environmental — ESG ↑

ESG requirements, sustainable finance, “green” products, and disclosure.

Colors and Indicators:

The color and size of each circle represent the type and strength of a trend’s impact on a scenario:

Blue — strong structural impact

(the scenario is critically dependent on this trend)

Yellow — moderate / indirect impact

(economic conditions or delayed response effects)

Green — opportunity and growth

(positive strategic direction)

White — background or systemic factor

(not a primary driver, but shapes the operating environment)

Interpretation for the “Opening a Bank in the U.S.” Case:

- S1 RegTech Squeeze → requires a strong RegTech architecture and advanced KYC/AML automation.

- S2 High-Rate Drag → highlights risks of prolonged high interest rates constraining growth.

- S3 Green Finance Push → creates strategic opportunities in ESG banking and sustainable finance.

- S4 Data-Controlled Digital World → emphasizes the critical importance of data governance, privacy-by-design, and compliance-first digital products.

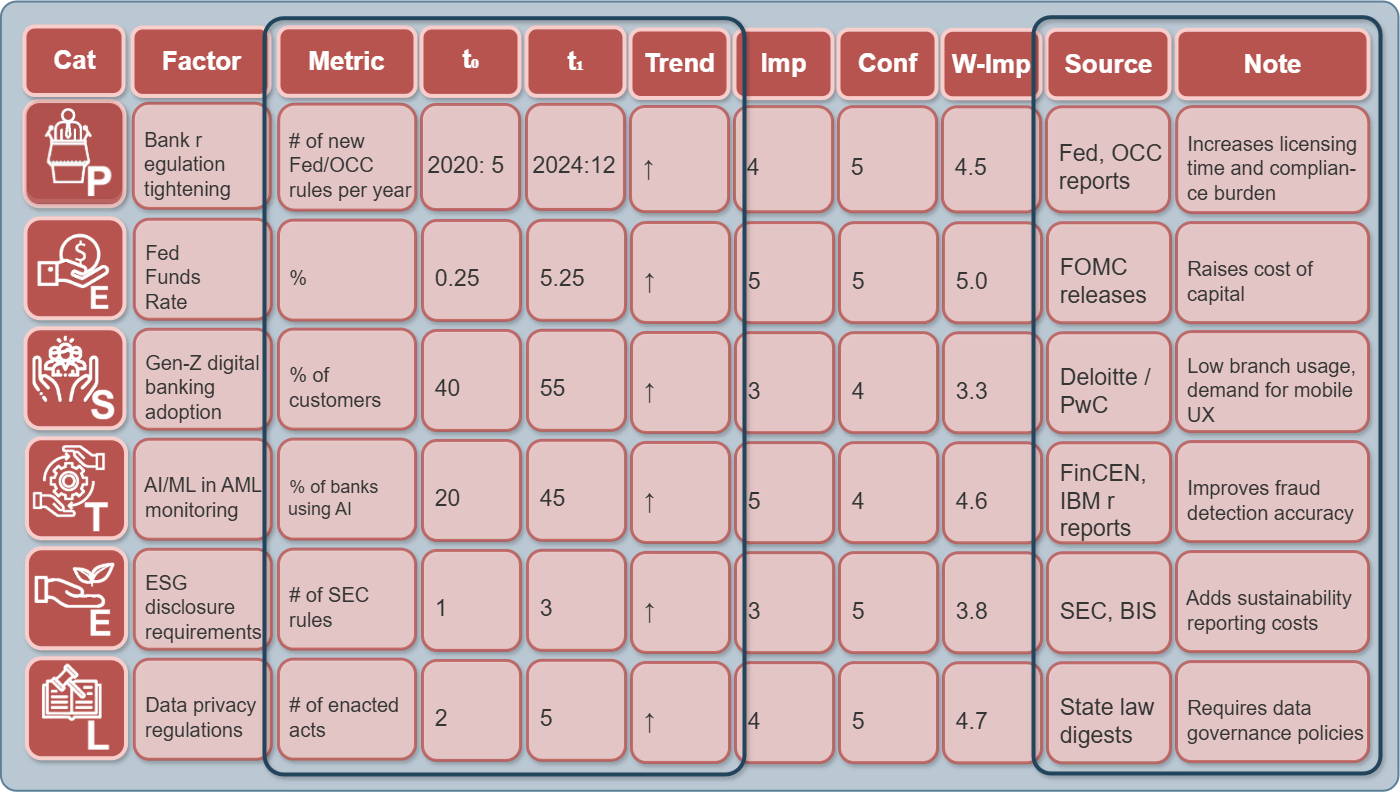

Source Evidence Panel (Data Provenance & Confidence Levels)

Political — Fed, OCC reports

Economic — FOMC releases

Social — Deloitte / PwC

Technological — FinCEN, IBM reports

Environmental — SEC, BIS

Legal — State law digests

Purpose:

- Understand which external forces shape the industry and where the main risks and opportunities are located.

What it Shows:

- The data sources on which the trend assessment is based (e.g., Fed, OCC, FinCEN, Deloitte).

- The level of confidence in each source is expressed using star ratings.

- This serves as the foundation for substantiating each trend within the PESTEL analysis.

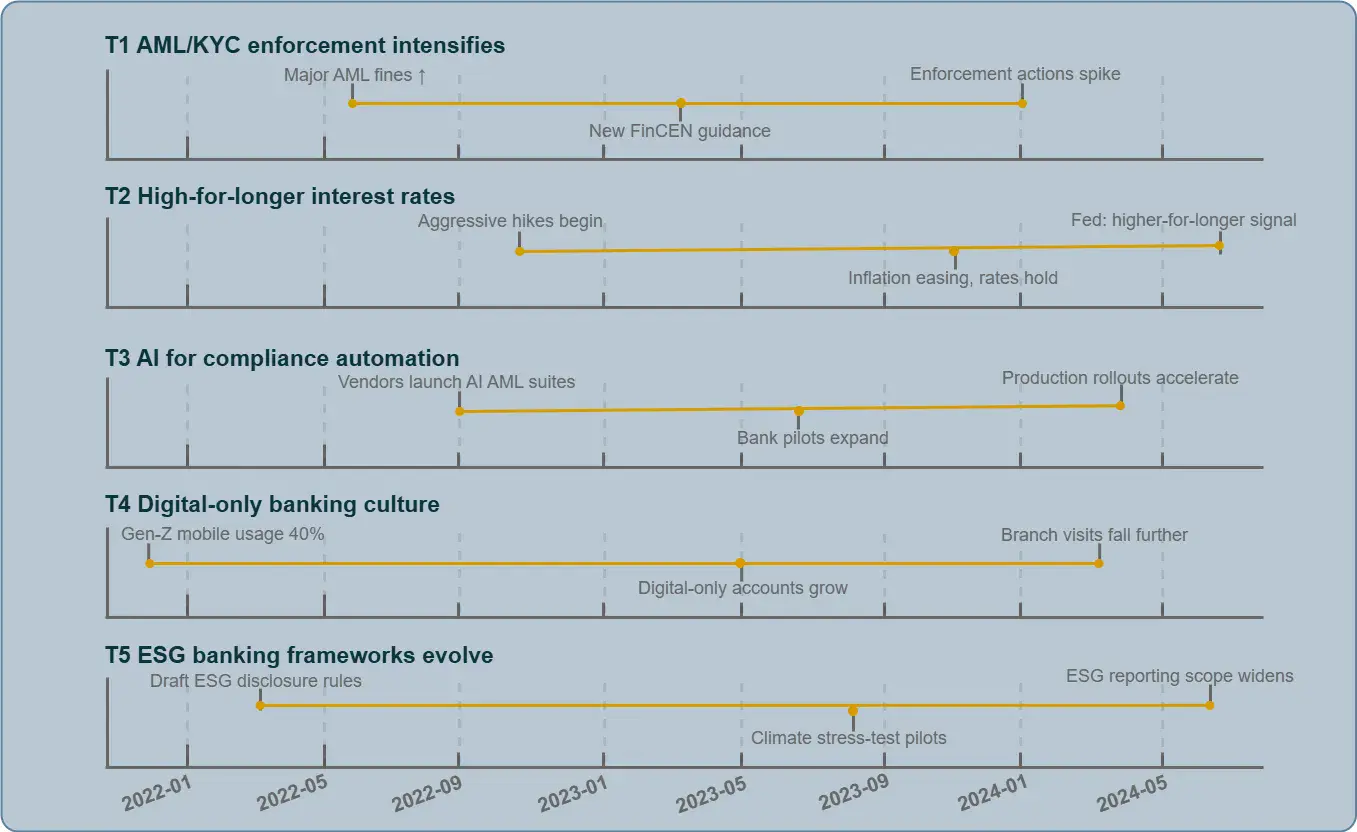

Signals Timeline — Evidence per Trend

Purpose:

- It illustrates the trajectories of trends and the moments when they intensify, helping identify which trends are moving from “observed” to “active” drivers.

This allows analysts to distinguish early signals from structurally embedded forces shaping the market environment.

What it Shows:

The dynamics of signals over time for each trend.

For example:

- T1 — AML/KYC enforcement intensifies → increased AML penalties and new FinCEN guidance.

- T2 — High-for-longer interest rates → a prolonged high Federal Reserve interest rate environment.

- T3 — AI for compliance automation → growing adoption of AI in AML processes.

Trend Priority Bubble Chart — Improved Readability

What it Shows:

The dynamics of signals over time for each trend.

For example:

- T1 — AML/KYC enforcement intensifies → increased AML penalties and new FinCEN guidance.

- T2 — High-for-longer interest rates → a prolonged high Federal Reserve interest rate environment.

- T3 — AI for compliance automation → growing adoption of AI in AML processes.

Purpose:

Helps identify which trends are most critical in the near term:

- AI and AML/KYC enforcement → short time horizon (0–2 years), high priority.

- ESG and digital culture → long-term trends with lower immediate urgency.

Outputs:

- Trend matrix with time horizons;

- Prioritization by likelihood and impact strength;

- A shortlist of trends for interdependency analysis (input for Cross-Impact Assessment).

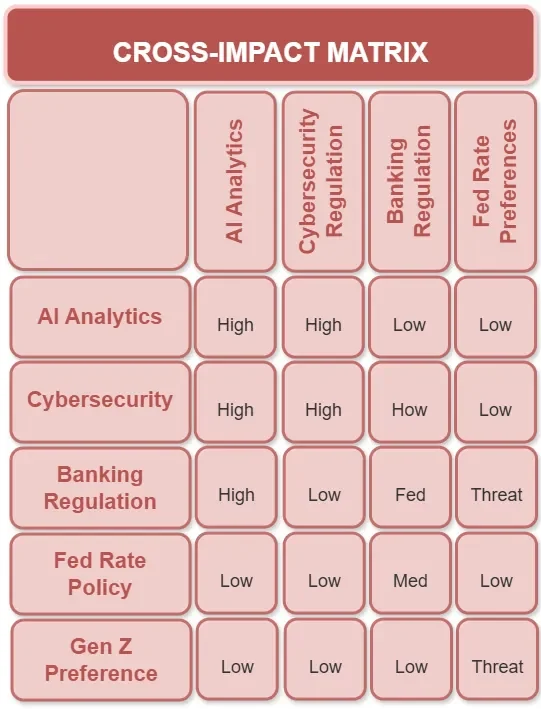

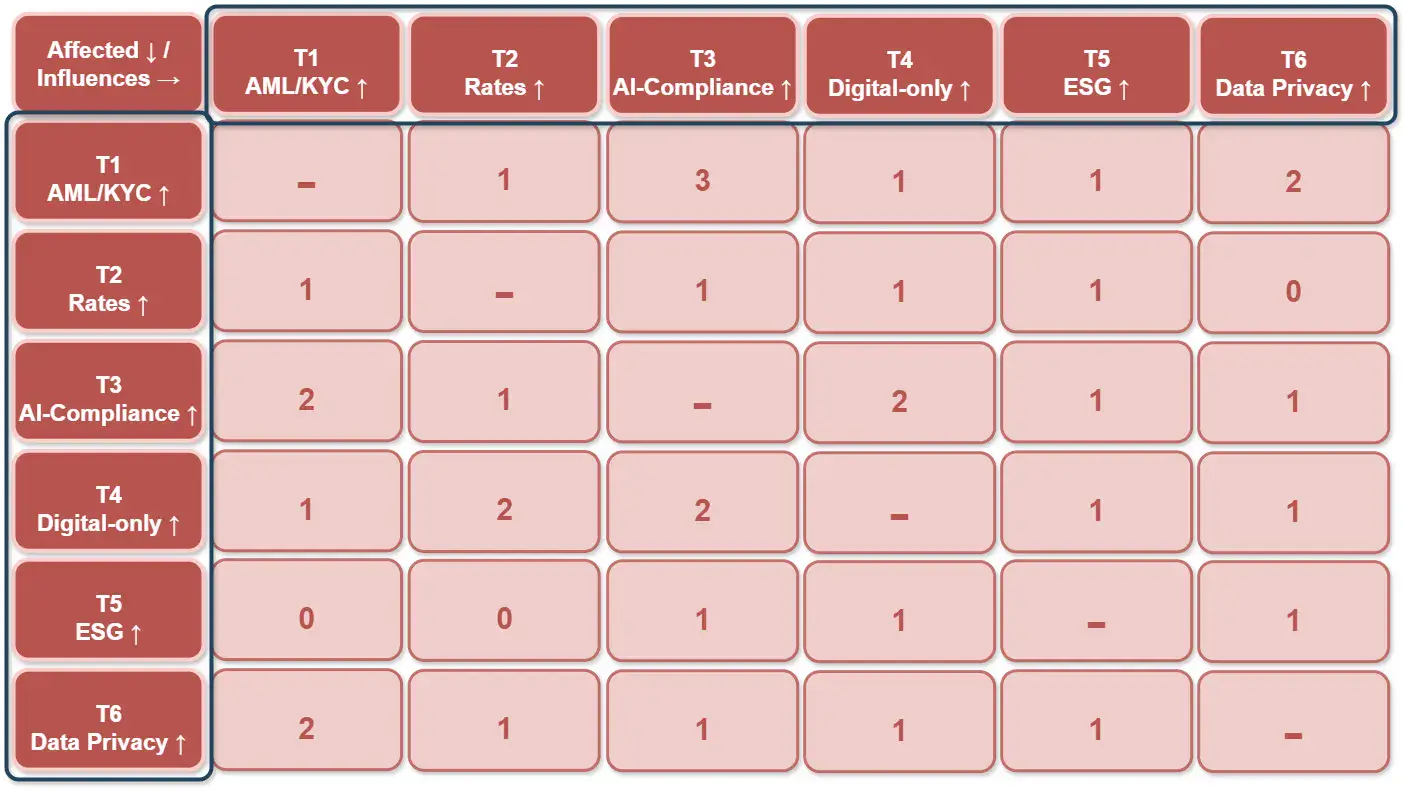

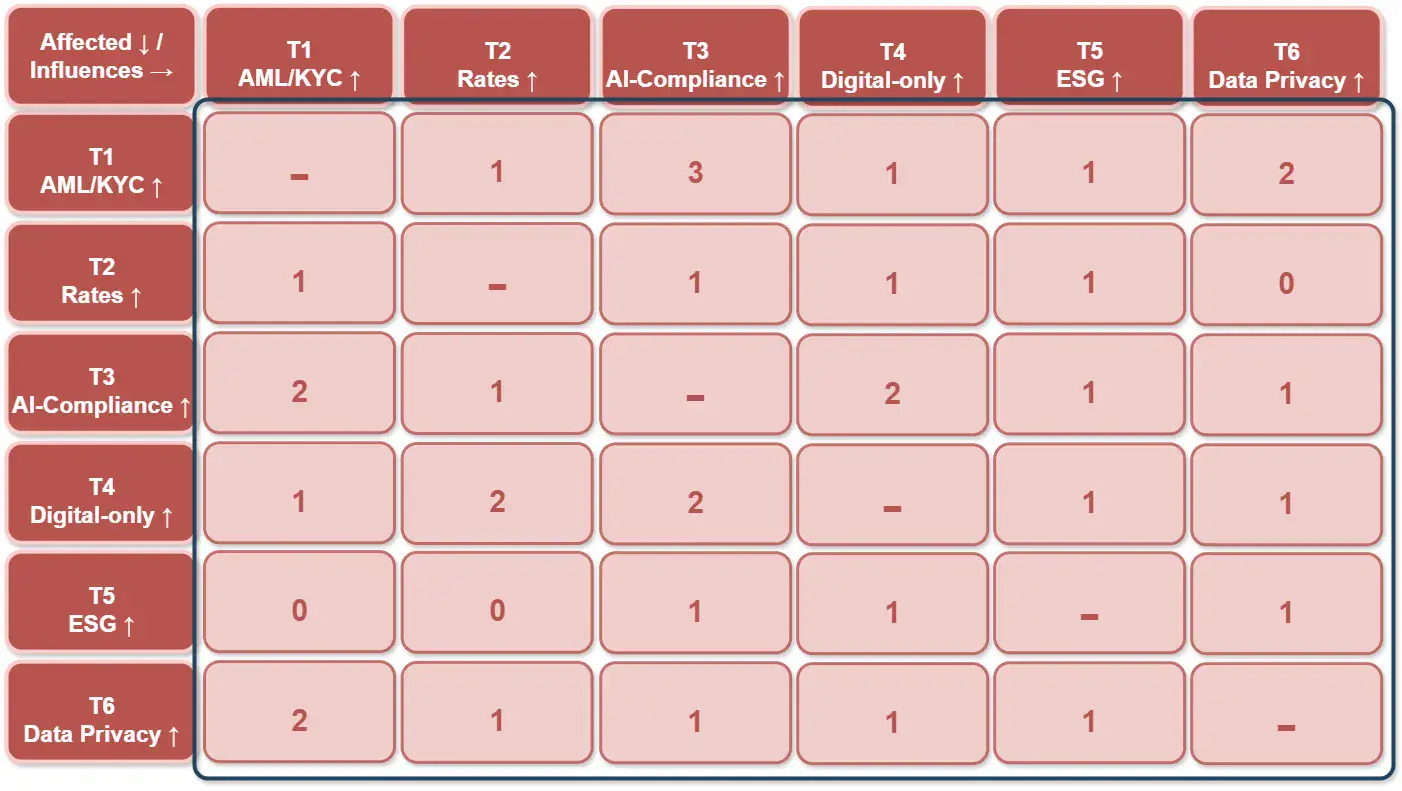

Cross-Impact Assessment

Purpose:

- To identify the mutual influence between trends and factors in order to understand which changes can trigger chain reactions and tipping-point scenarios, and to highlight the key drivers and vulnerabilities that shape future strategic outcomes.

Opening a Bank in the U.S.

The Cross-Impact method makes it possible to:

- build an interaction matrix between factors;

- assess how one factor influences another;

- identify chain reactions (for example: “growth of digitalization → new privacy risks → tightening of legal regulation”).

Methodology

Step 1. Use Trends from the Scenario Trend Scan.

Select 6–10 factors with high impact.

Matrix axes:

-

Columns (Influences):

“who influences” (sources of impact).

-

Rows (Affected):

“who is affected” (objects of impact).

Step 2. Build the Interaction Matrix

What exactly is evaluated: Not categories.

We evaluate specific trends identified in the previous step, for example:

- T1 — Intensifying AML/KYC enforcement

- T2 — High-for-longer Fed rates

- T3 — AI-driven AML/Fraud analytics adoption

- T4 — Digital-only banking among Gen Z

- T5 — State data-privacy expansion

- T6 — ESG disclosure requirements

-

Cells:

impact strength (H / M / L or 3 / 2 / 1). No single factor ever exists in isolation.

For example, technological progress can stimulate changes in legislation, while the environmental agenda can accelerate the development of green technologies.

Scale:

- 0 — no noticeable impact

- 1 (Low) — weak

- 2 (Med) — moderate

- 3 (High) — strong

(optionally, a +/− sign can be added to indicate the nature of the impact: reinforcing / restraining)

Step 3. Interpretation of Results

- Factors with multiple values of 3 (High) in rows → drivers of change (initiators).

- Factors with multiple values of 3 (High) in columns → vulnerable points (dependent elements of the system).

Derived Scores:

Interpretation and Metrics:

-

Driver Score (∑ across the row):

— the total impact of a trend on other factors → indicates who “drives the system.”

-

Vulnerability Score (∑ down the column):

— the total impact of other factors on a given trend → indicates who is most dependent.

-

Key Drivers:

— trends with a high Driver Score and a relatively low Vulnerability Score.

-

Sensitive Nodes:

— trends with a low Driver Score and a high Vulnerability Score.

Interpretation and Metrics:

-

AML/KYC Enforcement ↑

(systemic regulatory driver)

-

AI Compliance ↑

(key technological enabler)

-

Digital-only Banking ↑

(consumer behavior driver)

-

ESG ↑

(shaping long-term requirements and standards)

-

Data Privacy ↑

(regulatory-systemic linking factor)

Cross-Impact Output → Input for Sensitivity Analysis:

The result of the Cross-Impact analysis is a set of logically connected trend clusters that form the foundation for scenario development.

S1 — RegTech Squeeze

T1 (AML/KYC ↑) + T6 (Data Privacy ↑) + T3 (AI Compliance ↑ as a response to regulatory pressure)

S2 — High-Rate Drag

T2 (Interest Rates ↑) + T4 (Digital-only ↑ as a market adaptation response)

S3 — Green & Lean Finance

T5 (ESG ↑) + T3 (AI Compliance ↑ to reduce costs and risks)

S4 — Data-Controlled Digital World

T6 (Data Privacy ↑) + T4 (Digital-only ↑) + T3 (AI Compliance ↑ as a governance mechanism)

→ a scenario in which digital banking evolves within a strict data-regulatory framework

Types of Drivers (Roles) in the Cross-Impact Matrix:

| Role | Description |

|---|---|

| Systemic Driver | The primary source of change that initiates chain reactions (e.g., AML/KYC enforcement, data privacy regulation) |

| Secondary Driver | A factor that reinforces or supports a systemic driver (e.g., ESG requirements) |

| Key Enabler | A catalyst or implementation tool for change (e.g., AI Compliance, RegTech automation) |

| Customer Driver | A shift in customer behavior that shapes market demand (e.g., Gen Z digital-only banking) |

| Constraint | A limiting factor that creates barriers (e.g., high interest rates) |

| Lagging Trend | An outcome of changes rather than their source (reacts to an already established environment) |

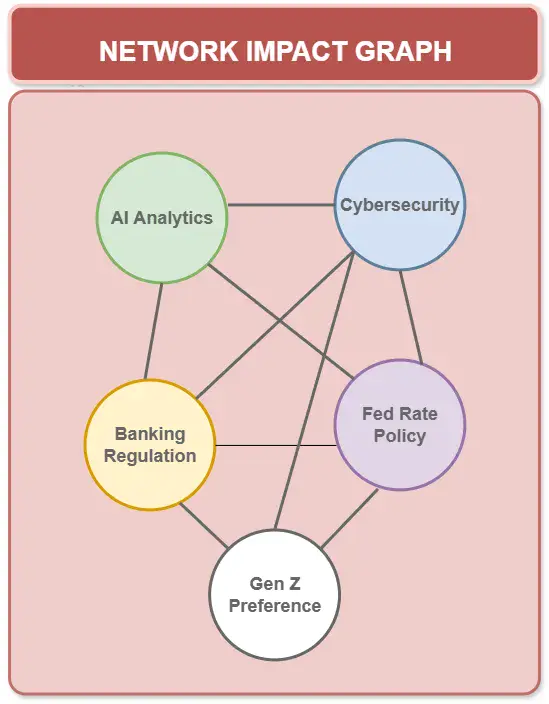

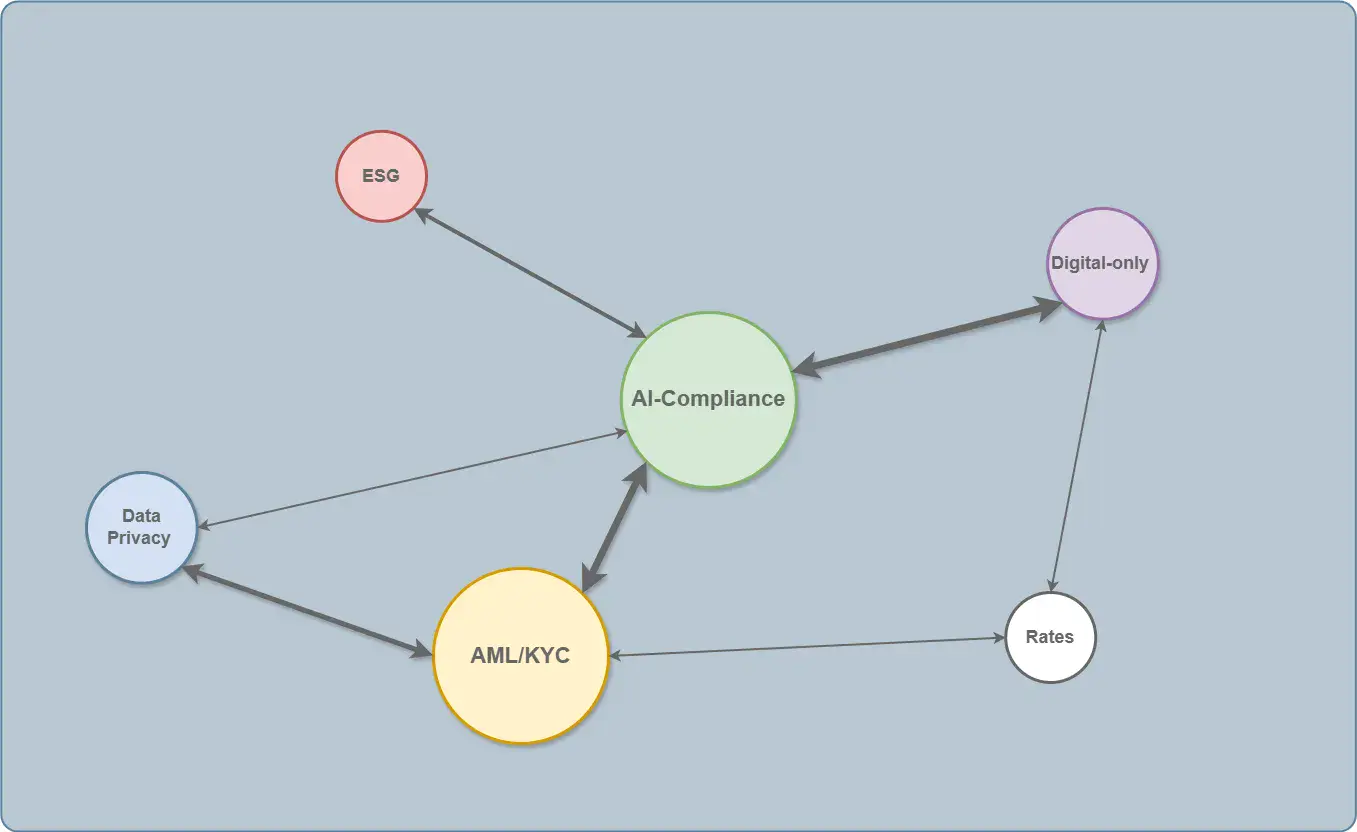

Step 4. Visualize the Relationships

Influence Network Graph (Directed, Weighted): Based on Cross-Impact Assessment

What it shows:

- Strengthening AML requirements leads to investments in AI → higher costs.

- Increases in Fed interest rates reduce margins → accelerate digitalization and cost optimization.

- Example:

T1 (AML/KYC) → T3 (AI Compliance) — strong relationship.T5 (ESG) → T3 — moderate relationship.

T2 (Rates) → T4 (Digital-only) — weak relationship.

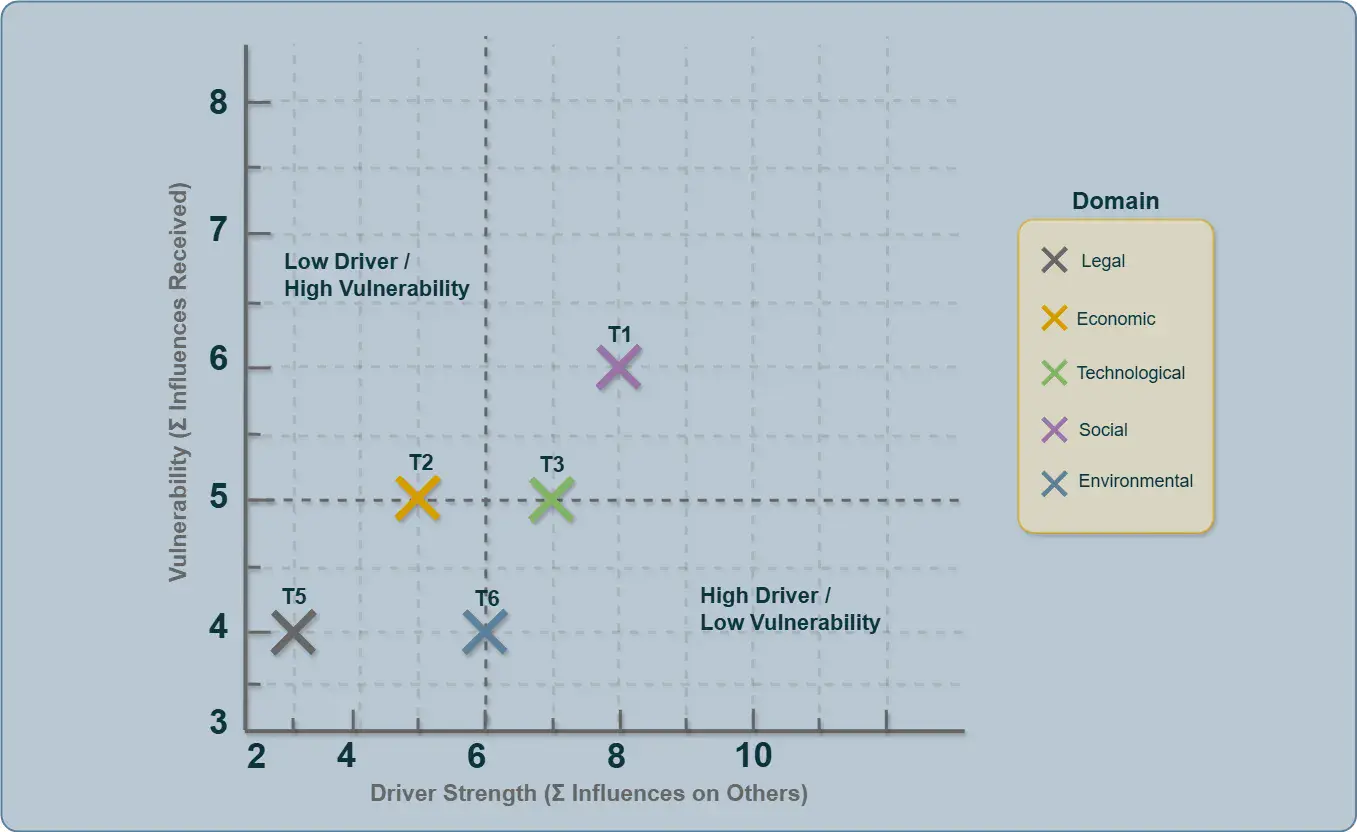

Driver vs Vulnerability Quadrant: Cross-Impact Assessment Summary

What it Shows:

Trends are positioned along two axes:

- Driver Strength — how strongly a factor influences others.

- Vulnerability — how strongly the factor itself depends on others.

Interpretation:

- T3 (AI Compliance) — strong driver, low vulnerability → a strategic growth point.

- T2 (Rates) — weak driver, high vulnerability → an external risk requiring adaptation.

- T5 (ESG) — weak driver but a stable background factor.

Outputs:

- Cross-Impact Matrix;

- Identification of drivers and dependent factors;

- A list of relationships for further sensitivity analysis.

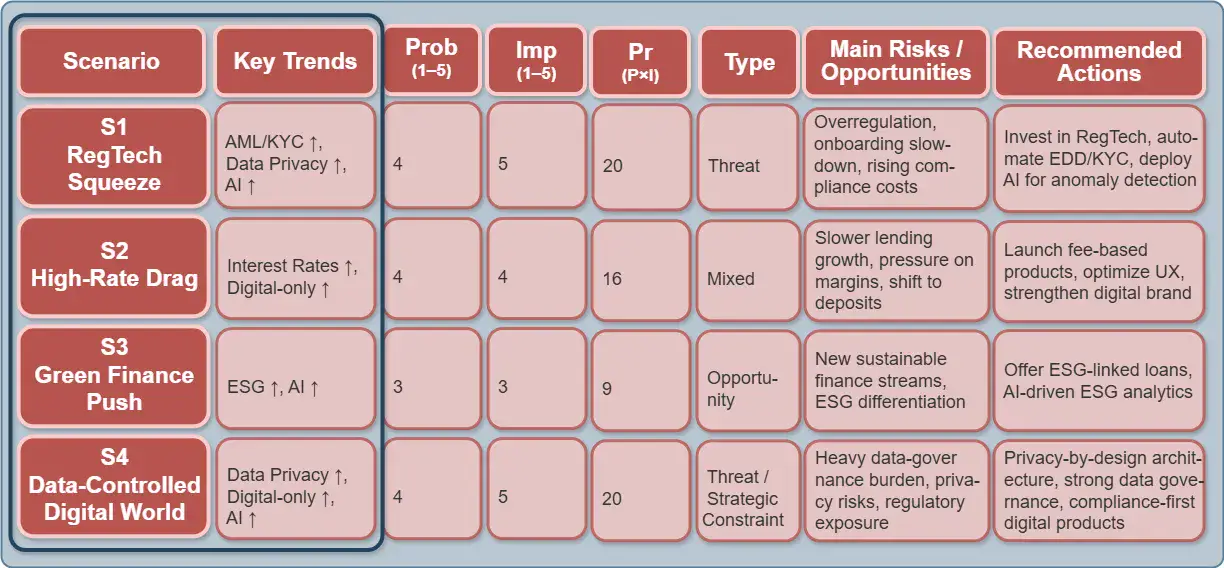

4. Sensitivity Mapping — Project Sensitivity to Scenarios

Purpose:

- To assess which combinations of trends (scenarios) are most critical for the project and to understand the project’s exposure to external uncertainty.

The sensitivity map helps prioritize monitoring and strategic actions by comparing scenario probability and impact.

Methodology

1.We form scenarios from clusters of trends identified through Cross-Impact (for example, “RegTech squeeze” = AML/KYC + Privacy + AI).

2.We evaluate each scenario using the following scales:

-

Business-as-Usual

— minimal changes

-

Disruption

— structural shifts and regulatory shocks

-

Transformation

— sustainable transformation of the banking model

We build a Sensitivity Matrix (probability × impact).

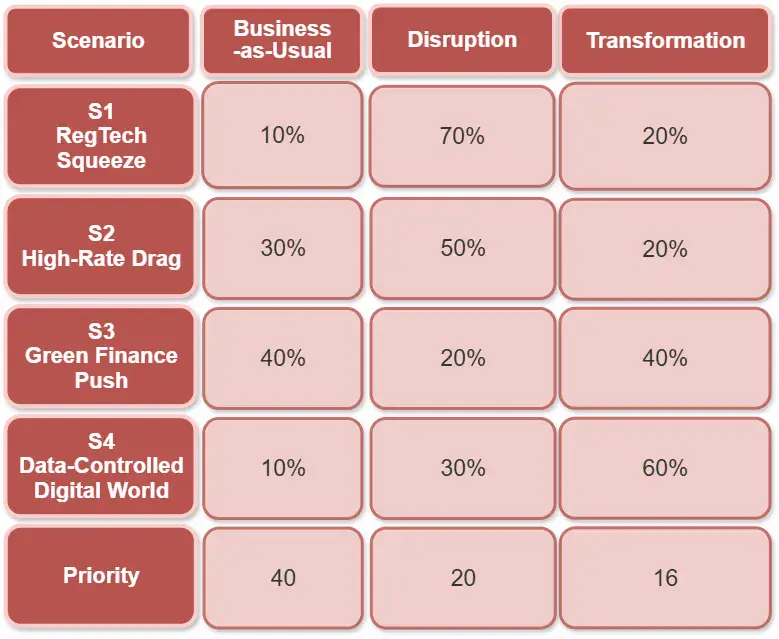

Sensitivity Matrix – Scenarios vs Outcomes

The table shows the probabilistic distribution of outcomes for three scenarios (S1–S4) depending on the type of future:

-

Probability (1–5)

— the total impact of a trend on other factors → indicates who “drives the system.”

-

Impact (1–5)

— strength of impact on the project;

-

Type

— Opportunity / Threat / Mixed;

-

Priority

= P × I — priority for monitoring.

The table shows the probabilistic distribution of outcomes for three scenarios (S1–S4) depending on the type of future:

What it Shows:

- S1 RegTech Squeeze has the highest concentration in the Disruption zone (70%), indicating a high likelihood of regulatory shocks that require immediate adaptation of AML/KYC and RegTech architecture.

- S2 High-Rate Drag shows a mixed profile with dominance in Disruption (50%), pointing to macroeconomic pressure and constraints on growth.

- S3 Green Finance Push has the most balanced distribution between Business-as-Usual and Transformation (40% / 40%), highlighting its evolutionary, long-term nature.

- S4 Data-Controlled Digital World is clearly shifted toward Transformation (60%), reflecting a systemic restructuring of banking around data governance, privacy-by-design, and compliance-first digital products.

Interpretation for the “Opening a Bank in the USA” Case:

S1 — RegTech Squeeze — the zone of maximum sensitivity and risk. A scalable RegTech architecture and AI-driven compliance automation are required.

S2 — High-Rate Drag — medium sensitivity. Flexibility in interest rate policy is needed, with a focus on fee-based and digital products.

S3 — Green & Lean Finance — a strategic opportunity to position the bank in ESG and sustainable finance.

S4 — Data-Controlled Digital World — the core transformational scenario that defines the rules of the game for all others: without mature data governance, the bank becomes non-viable regardless of macroeconomic conditions.

Scenario Composition Sankey (Trends → Scenarios)

What it Shows:

- How individual macro trends combine and form coherent market development scenarios.

- The diagram reflects the internal structure of the scenarios:

which forces shape them, how trends are grouped into logical clusters, and what roles they play in the development of each scenario (driver, constraint, catalyst).- The diagram reflects the internal structure of the scenarios:

Risk / Opportunity Matrix (Scenario Sensitivity Mapping)

What it Shows:

The matrix displays the probability of scenario occurrence and the strength of their impact on the project.

Color and marker indicate the scenario type:

- Red — Threat (S1 RegTech Squeeze: regulatory pressure and AML/KYC)

- Orange — Mixed (S2 High-Rate Drag: macroeconomic constraints with partial opportunities)

- Green — Opportunity (S3 Green Finance Push: ESG and sustainable financial models)

- Gray — Strategic Constraint (S4 Data-Controlled Digital World: a mandatory environment of strict data governance and digital compliance)

For the “Opening a Bank in the USA” Case:

-

Regulatory Pressure (S1)

— the zone of maximum risk, requiring immediate adaptation of architecture, AML/KYC processes, and RegTech.

-

High Interest Rates (S2)

— a scenario of managed uncertainty, affecting lending and deposit strategy.

-

ESG and AI Transformation (S3)

— a window of long-term opportunities and strategic positioning.

-

Data-Controlled Diital World (S4)

— a foundational constraint defining requirements for IT architecture, data, and compliance across all scenarios.

The matrix is used together with the Scenario Evaluation Table,

where risks, opportunities, and response measures are defined for each scenario.

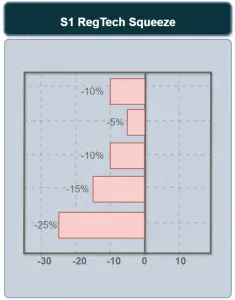

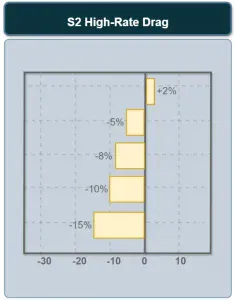

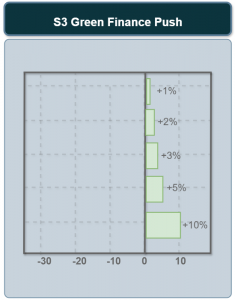

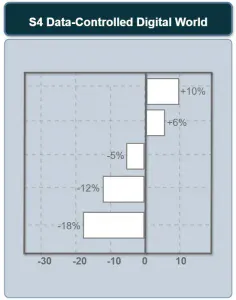

Scenario → KPI Tornado Chart

What it Shows:

- The diagrams illustrate changes in the project’s key KPIs relative to the baseline scenario for each of the four external environment scenarios.

- The length and direction of the bars indicate the magnitude and sign of impact (negative or positive) of each scenario on the bank’s financial, operational, and risk indicators.

Meaning:

- The diagrams make it possible to assess the sensitivity of the bank’s business model to different types of scenarios —

from regulatory shocks and macroeconomic pressure to strategic growth opportunities and systemic constraints. - They help to:

identify which scenarios represent critical risks (S1), determine which require an adaptive financial strategy (S2), highlight which form a window of opportunity (S3), and clarify which define the baseline rules of the bank’s long-term architecture (S4).

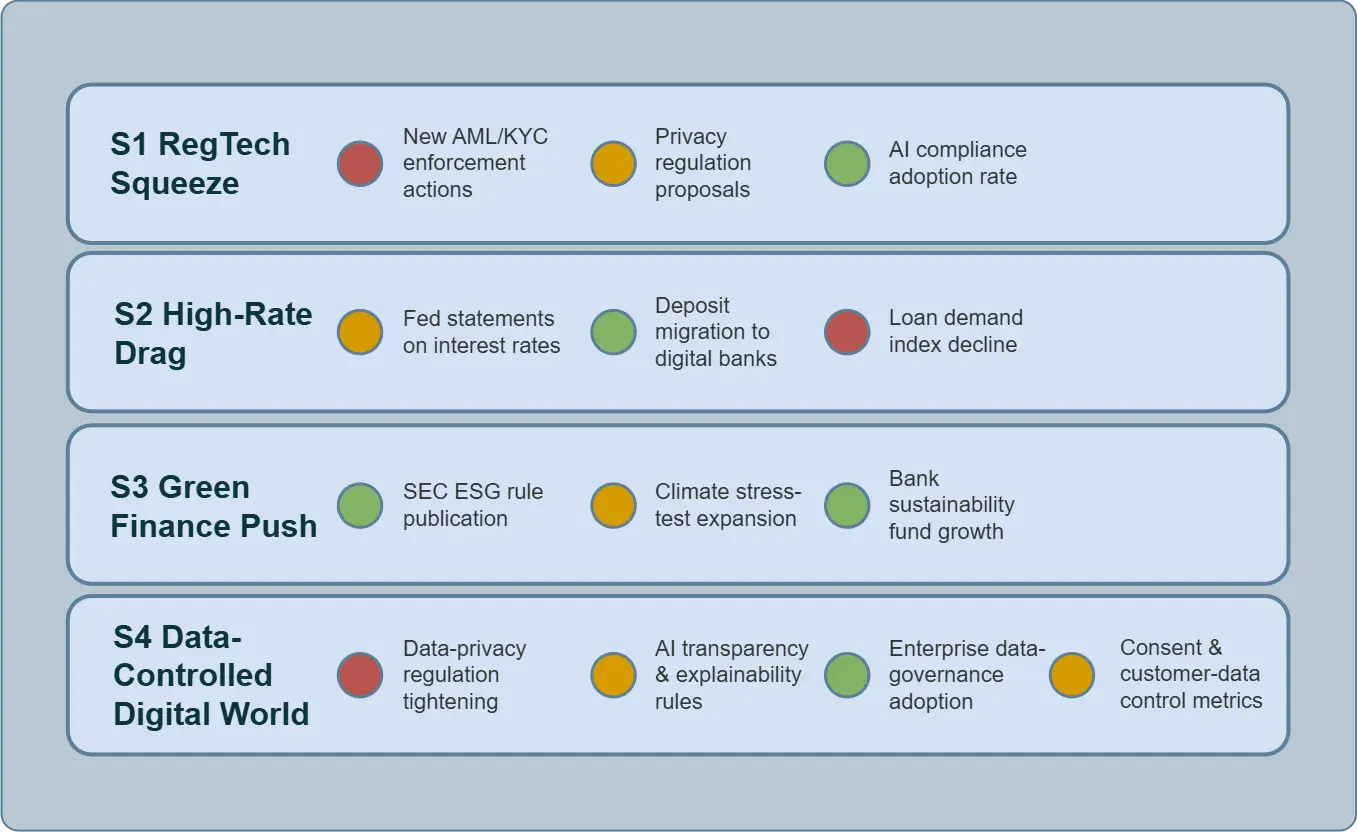

Trigger Monitor — RAG Dashboard (Scenario Monitoring Indicators)

What it Shows:

Indicators that need to be monitored in real time for early detection of a scenario.

RAG color coding:

Critical — the signal is active (e.g., new AML sanctions).

Critical — the signal is active (e.g., new AML sanctions).

Caution — the trend is strengthening (e.g., climate stress tests).

Caution — the trend is strengthening (e.g., climate stress tests).

Stable — control factors are within normal range.

Stable — control factors are within normal range.

Meaning:

- This is the final monitoring dashboard that translates the results of the analysis into a practical signal-based system for risk management.

Outputs:

- Map of external factors and trends — visualization of political, economic, social, and other influences on the industry.

- Set of development scenarios — descriptions of possible future states of the environment, with an assessment of their probability and risks.

- List of opportunities and threats (O/T) — concrete inputs for the project’s SWOT analysis.

| Stage | Input Data | Output (Result) | Transitions To |

|---|---|---|---|

| Scenario Trend Scan | Validated factors with sources | Trend priorities, their dynamics and probabilities | Cross-Impact Assessment |

| PESTEL | Research of factors by categories | Table of factors with weights | Scenario Trend Scan |

| Sensitivity Mapping | Scenarios from Cross-Impact | Map of risks, opportunities, and KPI sensitivity | Monitoring and strategy |

| Cross-Impact | Priority trends | Network of interconnections and drivers | Sensitivity Mapping |

Link to Subsequent Stages:

The results of macro-factor analysis serve as the foundation for competitive analysis:

they establish a fair “market background” and help identify which trends affect all players.

On this foundation, the following are built:

assessment of market opportunities (Opportunities);

identification of threats (Threats);

strategic scenarios for project adaptation.

How All Visualizations are Read Together:

-

PESTEL Table + Dashboard

→ shows the environmental context and pressure.

-

Trend Matrix + Trend Cards

→ shows trajectories of change.

-

Cross-Impact Matrix + Network Graph

→ shows mutual influence between trends.

-

Sensitivity Tables + Scenario Mapacy ↑

→ shows scenario priorities for action.

Overall Meaning of the “Opening a Bank in the USA” Case:

The Charts Show That:

Regulatory trends are intensifying (AML/KYC, Privacy).

Technological trends (AI, RegTech) are becoming the response to pressure.

Social trends (Gen Z digital adoption) are shifting the business model online.

The economic environment (high-for-longer rates) constrains growth.

As a result, three systemic scenarios emerge:

RegTech Squeeze (threat/opportunity) — rising costs and innovation in compliance.

High-Rate Drag (threat) — pressure on margins and cost of capital.

Green & Lean (opportunity) — growth of green products and technological efficiency.